Choosing the Right Forex Trading Broker: A Comprehensive Guide

When embarking on your forex trading journey, the first and one of the most crucial steps is selecting the right forex trading brokers Global Trading Brokers. Your chosen broker can significantly influence your trading experience, profitability, and overall success in the financial markets. In this guide, we will delve into the various factors you need to consider when choosing a forex broker, discuss different types of brokers, and provide tips and insights to help you make an informed decision.

Understanding Forex Trading Brokers

Forex trading brokers act as intermediaries between traders and the foreign exchange market. They provide platforms for traders to buy and sell currencies, access market data, and implement trading strategies. It’s essential to understand the types of brokers available, as they operate under different models.

Types of Forex Brokers

Forex brokers can generally be categorized into three main types:

- Market Makers: These brokers create their own market and set their own prices. They typically offer fixed spreads and are suitable for novice traders who prefer more predictable trading conditions.

- ECN Brokers: Electronic Communication Network (ECN) brokers connect traders directly to the interbank market. They offer variable spreads and no dealing desk intervention, making them a preferred choice for experienced traders.

- STP Brokers: Straight-Through Processing (STP) brokers act as intermediaries, routing orders directly to liquidity providers. They typically offer lower spreads than market makers but may have additional commissions.

Key Features to Consider

When evaluating forex trading brokers, several essential features should influence your decision:

1. Regulation and Licensing

Regulation is paramount in forex trading. A broker’s credibility and reliability largely depend on its regulatory status. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the USA, and the Australian Securities and Investments Commission (ASIC) enforce strict rules to protect traders. Before opening an account, ensure that your broker is regulated by a reputable authority.

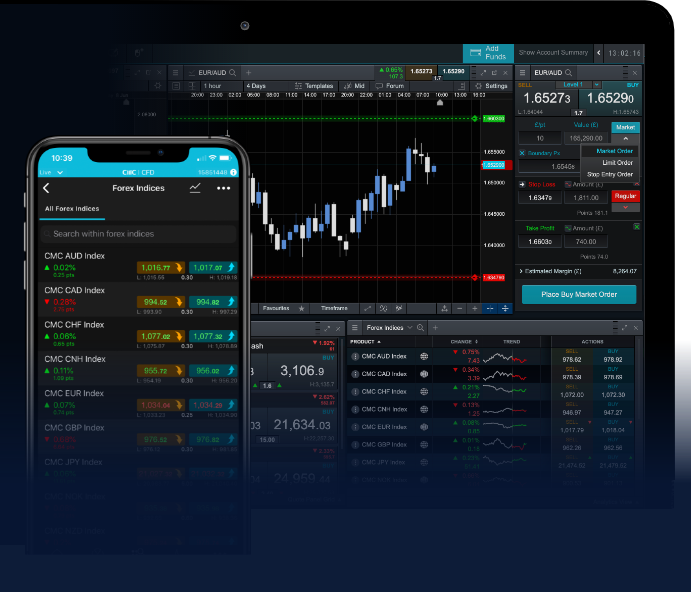

2. Trading Platforms

The trading platform is your primary tool for executing trades, analyzing market trends, and managing your portfolio. Popular platforms like MetaTrader 4, MetaTrader 5, and proprietary platforms each have unique features. Look for user-friendly interfaces, customizable charting tools, and compatibility with mobile devices.

3. Currency Pairs Offered

Different brokers provide access to varying currency pairs. Ensure that your broker offers the currencies you intend to trade. Major pairs like EUR/USD, GBP/USD, and USD/JPY should be available, as well as exotic pairs if you’re looking for more volatility.

4. Spreads and Commissions

Understanding the costs of trading is crucial. Brokers might charge spreads, commissions, or both. Compare the fees across different brokers, keeping in mind that some may offer lower spreads but higher commissions, while others have fixed pricing models. Balance your trading style with the cost associated with each broker.

5. Leverage and Margin Requirements

Leverage allows traders to control larger positions with a smaller amount of capital. However, while it can amplify profits, it also increases risk. Different brokers offer varying leverage levels, so assess your risk tolerance and choose accordingly. Additionally, check the margin requirements that come with the leverage offered.

6. Customer Support

Reliable customer support can make a big difference, especially for novice traders who may have questions or encounter issues. Look for brokers providing multiple contact methods, such as live chat, email, and phone support, and check their availability hours.

Tips for Choosing the Right Broker

As you navigate through your options, here are some tips to keep in mind:

- Do Your Research: Take the time to read reviews, compare brokers, and understand each entity’s reputation within the trading community.

- Open a Demo Account: Most brokers offer demo accounts, which allow you to test their platform, explore features, and practice trading without risking real money.

- Check for Educational Resources: Prefer brokers that provide educational materials, webinars, and tutorials. This is especially valuable for beginners looking to enhance their trading knowledge.

- Be Aware of Trading Conditions: Examine leverage, spread types, and minimum deposit requirements. Make sure these conditions align with your trading strategy.

- Consider Withdrawal and Deposit Options: A multitude of deposit and withdrawal methods offers flexibility. Verify the processing times and any fees related to these transactions.

Conclusion

Choosing the right forex trading broker is vital for your success as a trader. It requires careful consideration of various factors, including regulation, trading platforms, cost structures, and customer support. By conducting thorough research and weighing your options, you can align yourself with a broker that suits your trading style, risk appetite, and financial goals. Take your time, explore various brokers, and remember that the right choice can pave the way for a successful trading career.