Forex position trading is a strategy that involves holding positions for an extended period, typically weeks, months, or even years. This trading style requires in-depth knowledge of the market, including macroeconomic factors, interest rates, and geopolitical developments. Position traders focus on long-term trends rather than short-term fluctuations, allowing them to capitalize on the currency market’s natural movements. For those looking to engage in position trading, it is also essential to choose reliable resources and partners, like forex position trading Thailand Brokers, which can provide valuable insights and tools.

To comprehend position trading effectively, it is crucial to first understand its distinguishing characteristics compared to other trading styles, such as day trading or swing trading. While day traders might hold positions for minutes or hours, and swing traders typically keep trades open for days, position traders look at the big picture. They rely more on fundamental analysis than technical analysis, believing that understanding the underlying economic conditions will lead to successful trades over time.

One of the key elements of position trading is the need for discipline and patience. Unlike day traders who might respond quickly to market changes, position traders must be willing to sit on their trades and endure the inevitable fluctuations without panic selling. This approach allows them to avoid the noise that often short-term traders face, focusing instead on broader market trends.

Fundamental Analysis in Position Trading

Fundamental analysis is at the heart of successful position trading. This method involves evaluating economic indicators, such as GDP growth, employment rates, inflation, and interest rates. Position traders use this information to forecast currency movements based on a shared understanding of how these factors impact supply and demand for different currencies.

A position trader may analyze economic releases, central bank meetings, and political developments to determine where they believe currencies are headed. For example, if a country’s economy is growing rapidly, it may lead to appreciation in its currency as international investors flock to take advantage of the economic opportunities. On the other hand, if a country is facing economic challenges, its currency may weaken.

Risk Management in Position Trading

Effective risk management is crucial in position trading, as it helps protect capital and limit losses. Position traders often use stop-loss orders to define potential exit points ahead of time. A stop-loss order automatically closes a position if the market reaches a predetermined price. This strategy can help mitigate losses in case the market moves against the trader’s position.

Additionally, position traders should determine the appropriate position size based on their overall capital and risk tolerance. A common rule is to risk no more than 1-2% of the total trading capital on any single trade. By ensuring that no single loss can significantly affect their portfolio, traders can maintain stability over the long term.

Tools and Resources for Position Traders

Position trading requires specific tools and resources to analyze data effectively and make well-informed decisions. Platforms that provide up-to-date economic calendars, market news, and research reports can give traders the upper hand. Many online brokers offer these resources, making it vital to choose a platform suited for position trading.

Additionally, traders should take advantage of various technical analysis tools. While position trading is primarily driven by fundamentals, combining it with technical analysis can provide a more comprehensive view of the market. Indicators such as moving averages, trendlines, and support and resistance levels can help traders identify potential entry and exit points.

Emotional Discipline in Position Trading

Emotion plays a significant role in trading success. Position traders need to cultivate emotional discipline, especially given the long-term nature of this trading style. The market can experience swings that might tempt traders to deviate from their plans and exit positions prematurely. Developing a solid trading plan and adhering to it is instrumental in preventing emotionally driven decisions.

Furthermore, keeping a trading journal can help position traders reflect on their performance, thought processes, and decision-making. By documenting trades, traders can analyze what works and what doesn’t, leading to continuous improvement and a more systematic approach to trading.

Choosing Currency Pairs for Position Trading

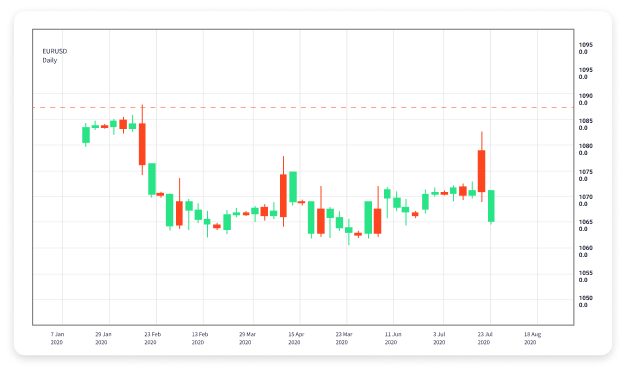

Not all currency pairs are suitable for position trading, and traders should focus on pairs that display consistent trends and volatility. Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, are often preferred because they are more liquid and have better price transparency. Understanding the correlation between currency pairs can also help traders make more informed decisions.

Position traders may also want to consider pairs that have a fundamental story behind them, as these are likely to have solid trends over time. For example, if a central bank is expected to raise interest rates, the currency associated with that central bank may appreciate against others. Position traders can capitalize on such expected movements by entering positions well ahead of the consensus.

The Importance of Staying Informed

Being informed about global economic developments is crucial for position traders. Following financial news, subscribing to economic reports, and engaging in trading forums can help traders stay updated on any events that may impact currency values. Additionally, traders can benefit from connecting with experienced traders or mentors who can provide insights based on their knowledge and experience.

Moreover, attending webinars, workshops, and online courses can help enhance a trader’s skills concerning position trading. Continuous learning will empower traders to adapt their strategies and remain competitive in the ever-evolving forex landscape.

Final Thoughts on Forex Position Trading

Forex position trading can be a rewarding trading style for those willing to dedicate the time and effort to understanding the market’s complexities. By implementing strong fundamental analysis, effective risk management strategies, and emotional discipline, traders can harness the potential for long-term profits.

As with any trading strategy, continuous improvement, market awareness, and a well-thought-out trading plan are essential. Position trading isn’t a get-rich-quick scheme; instead, it’s a disciplined approach that recognizes the market’s ebb and flow. By committing to this process, traders have the opportunity to thrive in the dynamic world of forex.